What Is Asset Allocation?

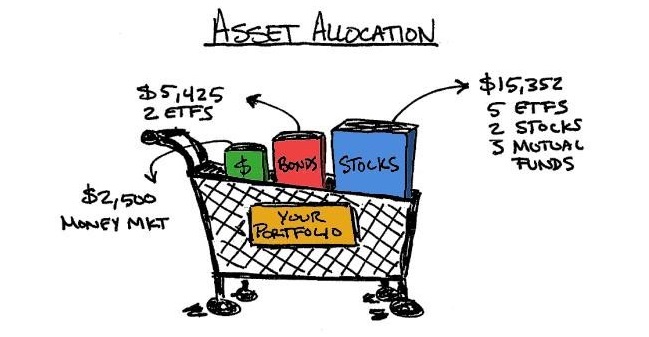

Asset allocation is an investment portfolio technique that aims to balance risk by dividing assets among major categories such as cash, bonds, stocks, real estate, and derivatives. Each asset class has different levels of return and risk, so each will behave differently over time.

For instance, while one asset category increases in value, another may be decreasing or not increasing as much. Some critics see this balance as a recipe for mediocre returns, but for most investors, it’s the best protection against a major loss should things ever go amiss in one investment class or sub-class.

With thousands of stocks, bonds and mutual funds to choose from, picking the right investments can confuse even the most seasoned investor. But if you don’t do it correctly, you can undermine your ability to build wealth and a nest egg for retirement.

Instead of stock picking, you should start by deciding what mix of stocks, bonds and mutual funds you want to hold. This is referred to as your asset allocation.

The consensus among most financial professionals is that asset allocation is one of the most important decisions that investors make.

There is no simple formula that can find the right asset allocation for every individual, I can, however, outline four points that I feel are important when thinking about balancing your portfolio:

1. Risk vs. Return

It’s easy for everyone to say that they want the highest possible return, but simply choosing the assets with the highest “potential” (stocks and derivatives) isn’t the answer.

The crashes of 1929, 1981, 1987 and the more recent declines of 2007-2009 are all examples of times when investing in only stocks with the highest potential return was not the most prudent plan of action. What separates greedy and return-hungry investors from successful ones is the ability to weigh the relationship between risk and return.

Yes, investors with a higher risk tolerance should allocate more money into stocks. But if you can’t remain invested through the short-term fluctuations of a bear market, you should cut your exposure to equities.

2. Determine Your Long- and Short-Term Goals

We all have our goals. Whether you aspire to build a fat retirement fund, own a yacht or vacation home, pay for your child’s education or simply save for a new car, you should consider it in your asset-allocation plan. All these goals need to be considered when determining the right mix.

For example, if you’re planning to own a retirement home on the beach in 20 years, you don’t have to worry about short-term fluctuations in the stock market. But if you have a child who will be entering college in five to six years, you may need to tilt your asset allocation to safer fixed-income investments. And as you approach retirement, you may want to shift to a higher proportion of fixed-income investments to equity holdings.

3. Time Is Your Best Friend

The U.S. Department of Labor has said that for every ten years you delay saving for retirement (or some other long-term goal), you will have to save three times as much each month to catch up. That’s an interesting fact.

Having time not only allows you to take advantage of compounding and the time value of money, but it also means you can put more of your portfolio into higher risk/return investments, namely stocks. A couple of bad years in the stock market will likely show up as nothing more than an insignificant blip 30 years from now.

4. Just Do It!

Once you’ve determined the right mix of stocks, bonds, and other investments, it’s time to implement it. The first step is to find out how your current portfolio breaks down.

It’s fairly straightforward to see the percentage of assets in stocks versus bonds, but don’t forget to categorize what type of stocks you own (small, mid or large cap). You should also categorize your bonds according to their maturity (short, mid or long-term).

Finally…

There is no single solution for allocating your assets. Individual investors require individual solutions. Furthermore, if a long-term horizon is something you don’t have, don’t worry. It’s never too late to get started.

It’s also never too late to give your existing portfolio a face-lift. Asset allocation is not a one-time event, it’s a life-long process of progression and fine-tuning.

Read more: https://julietkapena.com/how-would-you-retire/

Always helpful and serve as a guideline to those who are not very smart with handling money. Just a question (might be silly but…) what are you referring to when you say bonds and is there a possibility of a low income earner to invest in such or one needs to wait till a period whereby the earning potential is way more?

Hi Renee, nothing such as a silly question. 🙂 and yes you can invest in them too. You don’t need a huge amount to start off with. Bonds are low risk investments. A bond is a form of borrowing. When you buy a bond, you’re lending money, usually to a company or government, in exchange for a fixed rate of return. Bonds generally are considered safer investments than stocks, but they aren’t risk-free.

Bonds are often referred to as fixed-income securities because the lender (the investor) can anticipate the exact amount of cash they will receive if the bond is held until maturity. For example, say you buy a corporate bond with a face value of $2,000, a coupon of 5% paid annually, and a maturity of 10 years. This tells you that you will receive a total of $50 ($2,000 x 0.05) of interest per year for the next 10 years. You can click on the link below to read more:

https://www.thestreet.com/story/229831/1/the-different-kinds-of-bonds.html