It is difficult enough investing for yourself, so the prospect of investing for your children and the possibility it may go wrong is a challenge for even the most experienced investor – which may explain why so many parents procrastinate action for as long as they can.

History shows that even a ‘middle of the pack’ fund is likely to compare favourably with cash over 18 years. So, you don’t need to be an expert stock or fund picker to benefit from investing long term for the children.

What you do need is time to ride out the inevitable ups and downs in the market for a return that has tended to trump cash. The rule of thumb is to invest for a period of at least five or preferably ten years, to allow for stock market volatility.

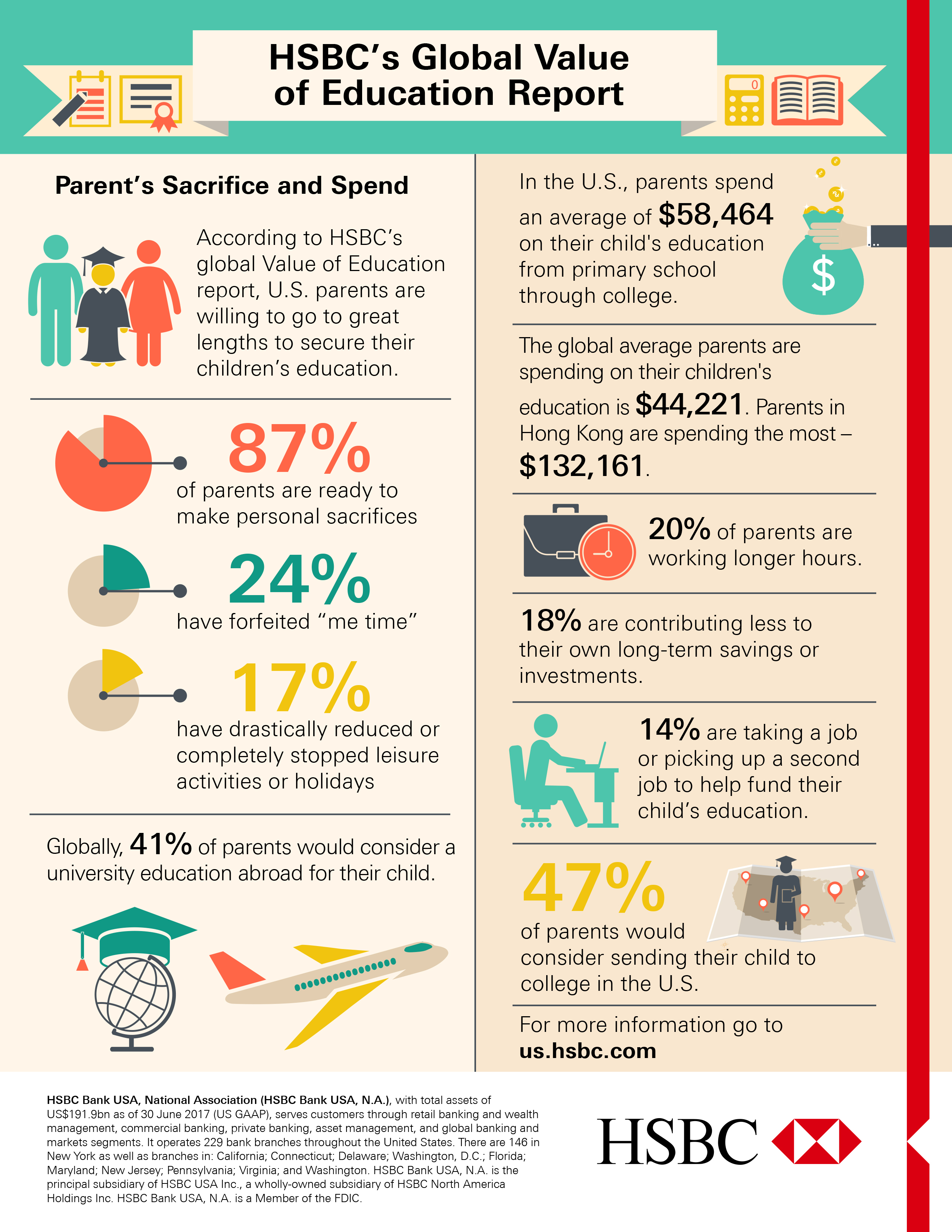

Have a look at the report below by HSBC. If the average cost of education for parents in the US from primary school through to college is $58,464 per child, then it means that a minimum of $200 per month (taking into consideration interest over the period and the varies or movement of the markets) would have to be saved as soon as the Child is born till age 18 to meet that goal. The more money one is able to save the quicker it will take to achieve the goal.

You could of course choose to do nothing until much later on, but with some early planning, you could avoid burdening your child with thousands of dollars of debt in the form of student loans.

If you are unsure about how to get started why not send us an email or drop a comment below and lets help get you started.

Great Insights Julie. I really learnt alot.

Chidinma